|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

No Bull | The Five Spot

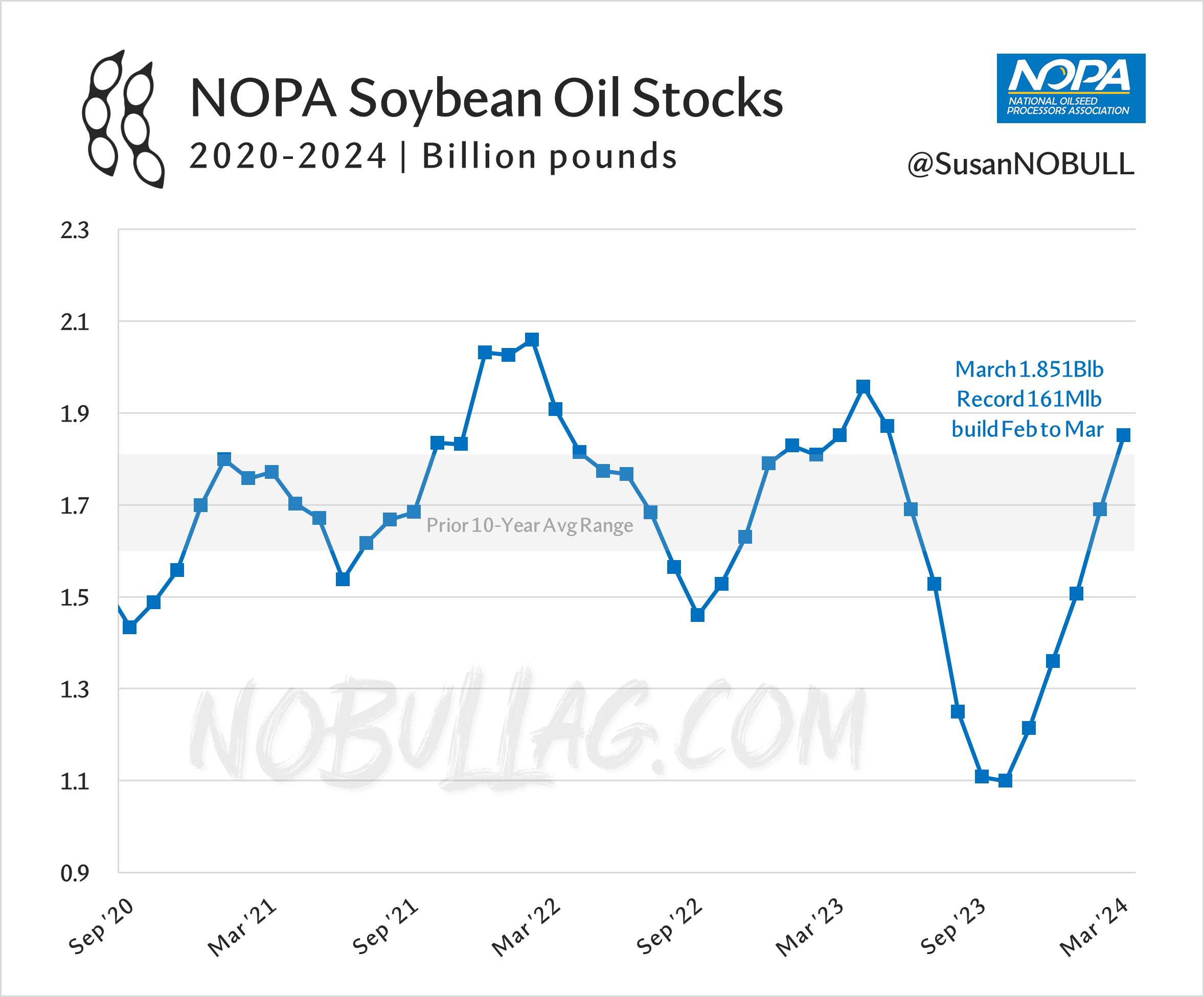

#5 | New HeightsCocoa and copper continued to make a run for it last week, especially cocoa which traded above $12,000/tonne briefly on Friday before settling at $11,878 - nearly $5.00 per pound! Everyone's new favorite commodity has broken since though, down nearly 15% to start the week.   #4 | New LowsAfter spending more than three years trading above the mid-40s, soybean oil fell to multi-year lows last week, erasing all of its renewable diesel-era gains. A break in palm and energy markets, plus an oversupply in renewables and soft interior basis levels have pressured oil lower in recent weeks. Additionally, dwindling crush margins, slowing crush rates and a slow start to Argentina's harvest have supported meal, resulting in an oilshare unwind, pushing oil lower by default.   #3 | OoofAfter a four-week buying streak in soybean oil, managed money turned sellers in a big way the past few weeks, dumping more than 12,000 contracts of oil in the week ending April 9, followed by a record puke of 53,295 contracts in the week ending April 16. Nearby futures fell 8% over the course of those two weeks of selling - a trend which likely continued into the end of last week as the market pushed into new lows on Friday.  Last week's increase in manage money's net short position dwarfs all other weekly changes:   #2 | A Record BuildMarch NOPA soybean oil stocks were 1.85 billion pounds, coming in above pre-report estimates and a record 161-million-pound build from February to March. Stocks are now up 68% from the start of the 2023/24 Marketing Year, compared with a 21% build at this point in 2022/23 and a mere 4% build in 2021/22 - which helps explain recent lethargic price action.   #1 | Winners & LosersComparing year-to-date performance of select commodities with stock indices and the 10-year, 2024 isn't exactly boding well for rural America:  For the full version of this post or to subscribe, visit NoBullAg.Substack.com. Thanks!  On the date of publication, Susan Stroud did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|