|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

2 ‘Strong Buy’ Growth Stocks Offering 300% or Higher Upside

Small-cap biotech stocks, while lacking the scale and financial stability of larger pharmaceutical giants, often have high growth potential. These companies are motivated by ground-breaking research, novel therapeutic approaches, and the prospect of meeting significant unmet medical needs. A single successful clinical trial, regulatory approval, or strategic collaboration can significantly boost a small-cap biotech’s value. At the same time, setbacks in drug development or funding challenges can cause steep declines. For those willing to brave the volatility, these “Strong Buy” small-cap biotechs offer a high-risk, high-reward opportunity. Biotech Stock #1: Astria TherapeuticsAstria Therapeutics (ATXS) is a clinical-stage biopharmaceutical company that currently focuses on hereditary angioedema (HAE) and atopic dermatitis. Valued at $386 million, Astria stock is down 30.7% year-to-date. Nonetheless, Wall Street predicts the stock can rally around 349% above current levels.

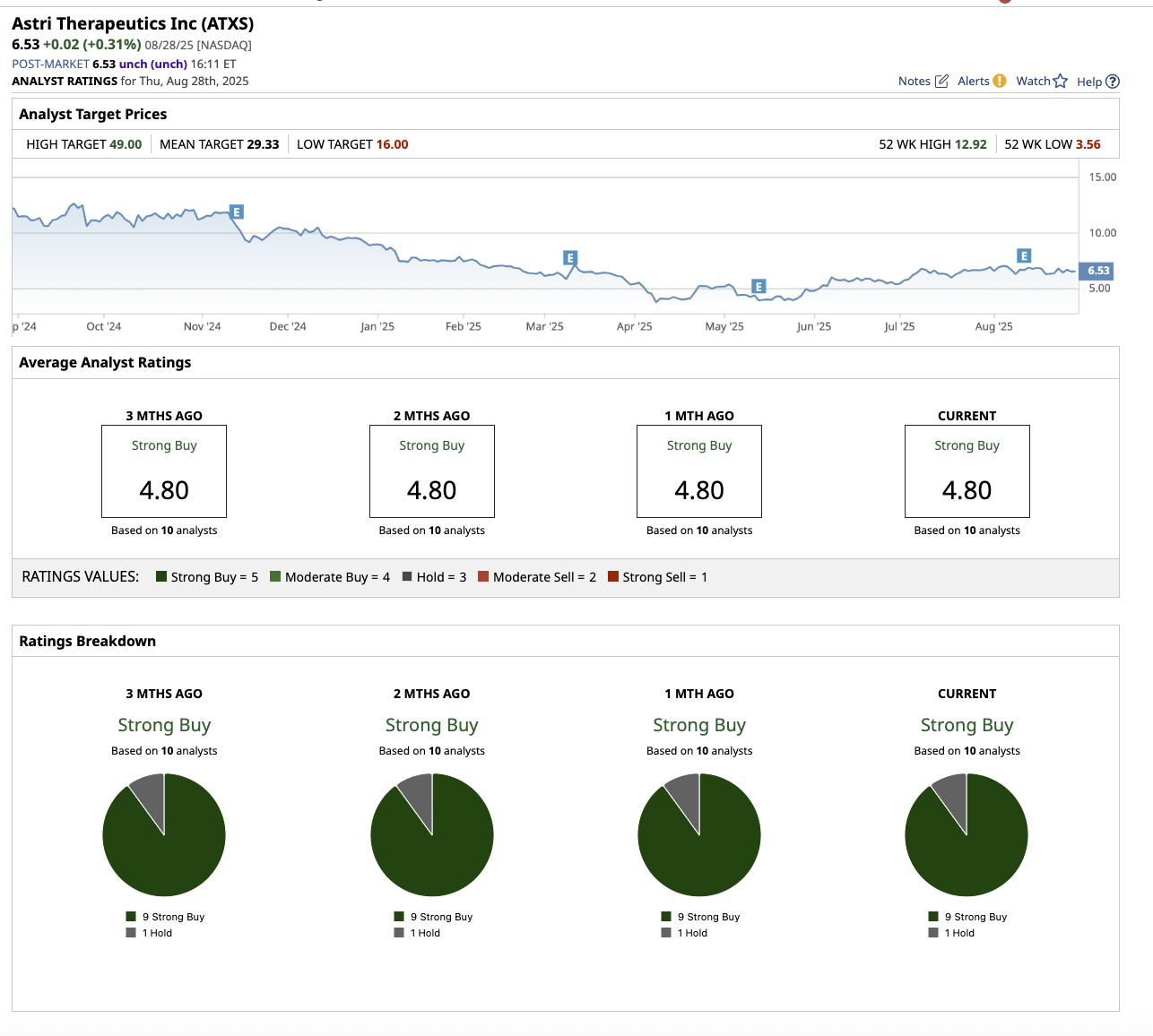

Navenibart, Astria’s lead asset, is a long-acting monoclonal antibody designed to target plasma kallikrein. The therapy seeks to establish a new standard of care for HAE by providing ultra-infrequent dosing, possibly once every three or six months. Initial clinical studies suggested that the therapy had a favorable safety profile. In the second quarter, Astria announced the completion of enrollment in the Phase 3 clinical trial (ALPHA-ORBIT), with top-line data expected in early 2027. Beyond HAE, Astria is advancing its second pipeline program, STAR-0310, a monoclonal antibody OX40 antagonist with YTE half-life extension technology, designed for atopic dermatitis (AD) and potentially other inflammatory diseases. In January 2025, Astria began a Phase 1a trial to test STAR-0310 in healthy subjects. The study will assess safety, tolerability, pharmacokinetics, and immunogenicity. The company anticipates providing initial proof-of-concept data in the third quarter of 2025. If successful, STAR-0310 has the potential to emerge as a best-in-class therapy in the highly competitive atopic dermatitis landscape, where existing treatments, while commercially successful, have room for improvement in durability and convenience. Being in the clinical stage, the company is burning through cash due to high R&D expenses of $25.9 million in the second quarter. This resulted in a net loss of $33.1 million, or $0.57 per share, compared to a net loss of $24.2 million, or $0.43 per share, in the second quarter of 2024. One of the quarter’s highlights was its licensing agreement with Kaken Pharmaceutical, which granted Kaken exclusive rights to develop and commercialize navenibart in Japan. Astria will receive a $16 million upfront payment, with the option to earn an additional $16 million in commercialization and sales milestone payments. With funding secured until 2028, Astria can focus on achieving clinical milestones without immediate risk of dilution. However, until the company has a successful product on the market, investing in a clinical-stage biotech company is risky. Overall, the word on the Street is a “Strong Buy” for ATXS stock. Of the 10 analysts that cover the stock, nine rate it a “Strong Buy,” and one rates it a “Hold.” The average target price for the stock is $29.33, which implies the stock can rally 374% above current levels. The high price estimate of $49 suggests the stock can climb 691% over the next 12 months.

Biotech Stock #2: Aardvark TherapeuticsWith a market cap of $184 million, Aardvark Therapeutics (AARD) is a clinical-stage biopharmaceutical company focused on developing novel, oral small-molecule therapies that target and suppress hunger as a means of treating metabolic diseases, including rare disorders characterized by excessive hunger. Aardvark distinguishes between two neurological drives: hunger and appetite. Its focus is on reducing hunger in order to better regulate eating habits. Aardvark’s stock has dipped 31% year-to-date, compared to the broader market gain. Nonetheless, Wall Street predicts the stock can rally nearly 300% above current levels.

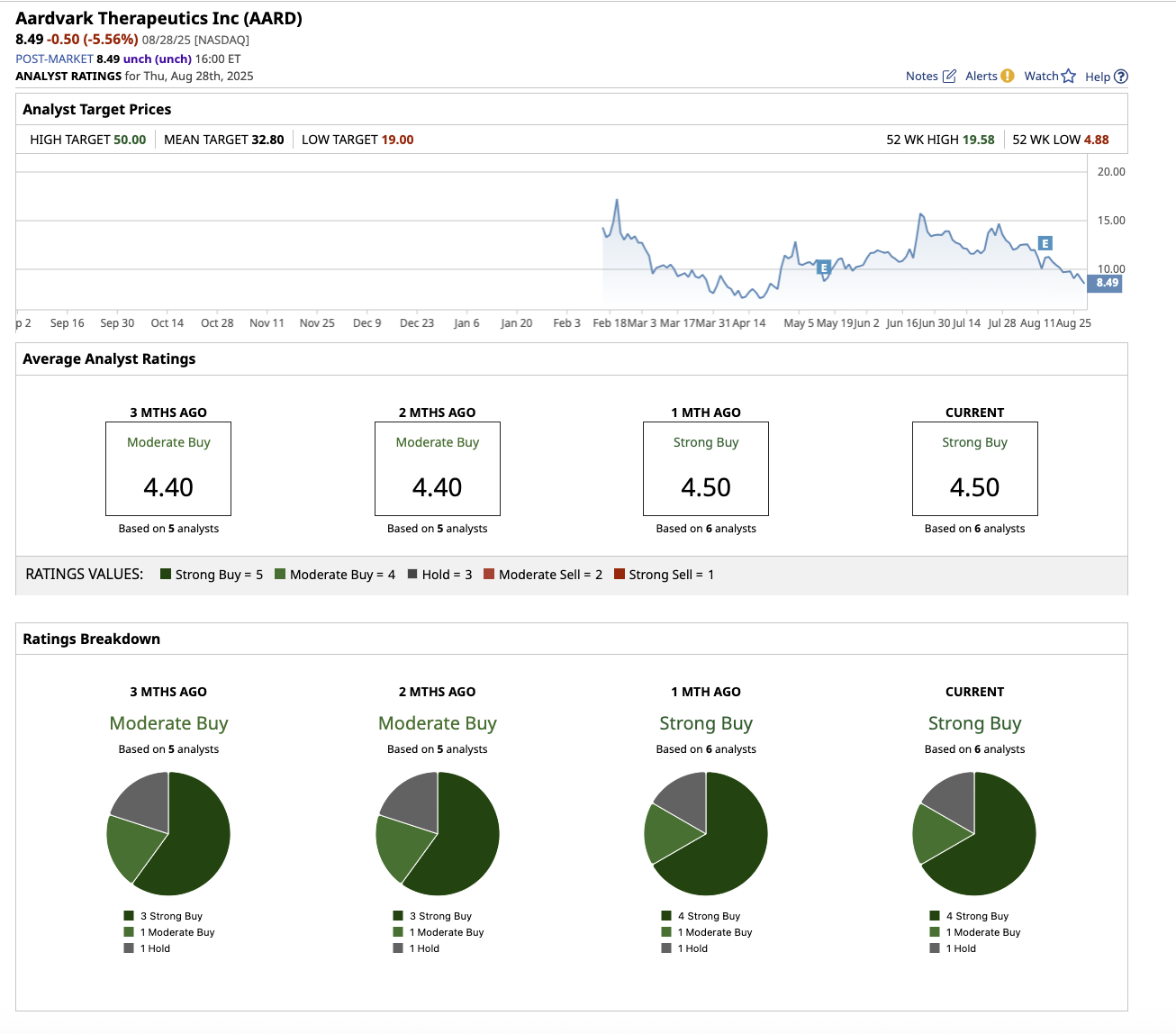

The second asset, ARD-201, is intended for obesity weight maintenance, addressing the unmet need to prevent weight regain, including after discontinuing GLP-1 receptor agonists. On Aug. 12, the company published new preclinical data demonstrating that ARD-201 not only caused significant weight loss in animal models, but also helped prevent weight rebound after discontinuing GLP-1 receptor agonist (GLP-1RA) therapy. In relation to ARD-201, the company is launching two separate trials designed to address specific clinical and commercial questions. The POWER Trial, which Aardvark launched in the second half of 2025, will assess ARD-201’s ability to prevent weight regain in patients who have already lost significant weight (around 15%) on GLP-1RA therapy but are discontinuing treatment. Meanwhile, the STRENGTH Trial, which is scheduled to begin in the first half of 2026, will evaluate ARD-201 as a monotherapy and in combination with GLP-1RAs, measuring placebo-adjusted weight loss and the additive effects of combining ARD-201 with existing GLP-1 therapies. Aardvark’s cash balance, including cash equivalents and short-term investments, totalled $141.8 million at the end of the second quarter of 2025. Management expects that this capital will support operations until 2027, giving the company enough time to complete its ongoing Phase 3 HERO trial and multiple Phase 2 obesity trials. In the quarter, R&D expenses increased to $13.1 million, resulting in a $14.4 million net loss. Overall, Aardvark stock is a “Strong Buy” on Wall Street. Of the six analysts that cover the stock, four rate it a “Strong Buy,” one rates it a “Moderate Buy,” and one rates it a “Hold.” The average target price for the stock is $32.80, which implies the stock can rally 290% above current levels. The high price estimate of $50 suggests the stock can climb 490% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|