|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

Why Warren Buffett is Buying Lennar Stock, and How to Invest in Housing Like a Billionaire

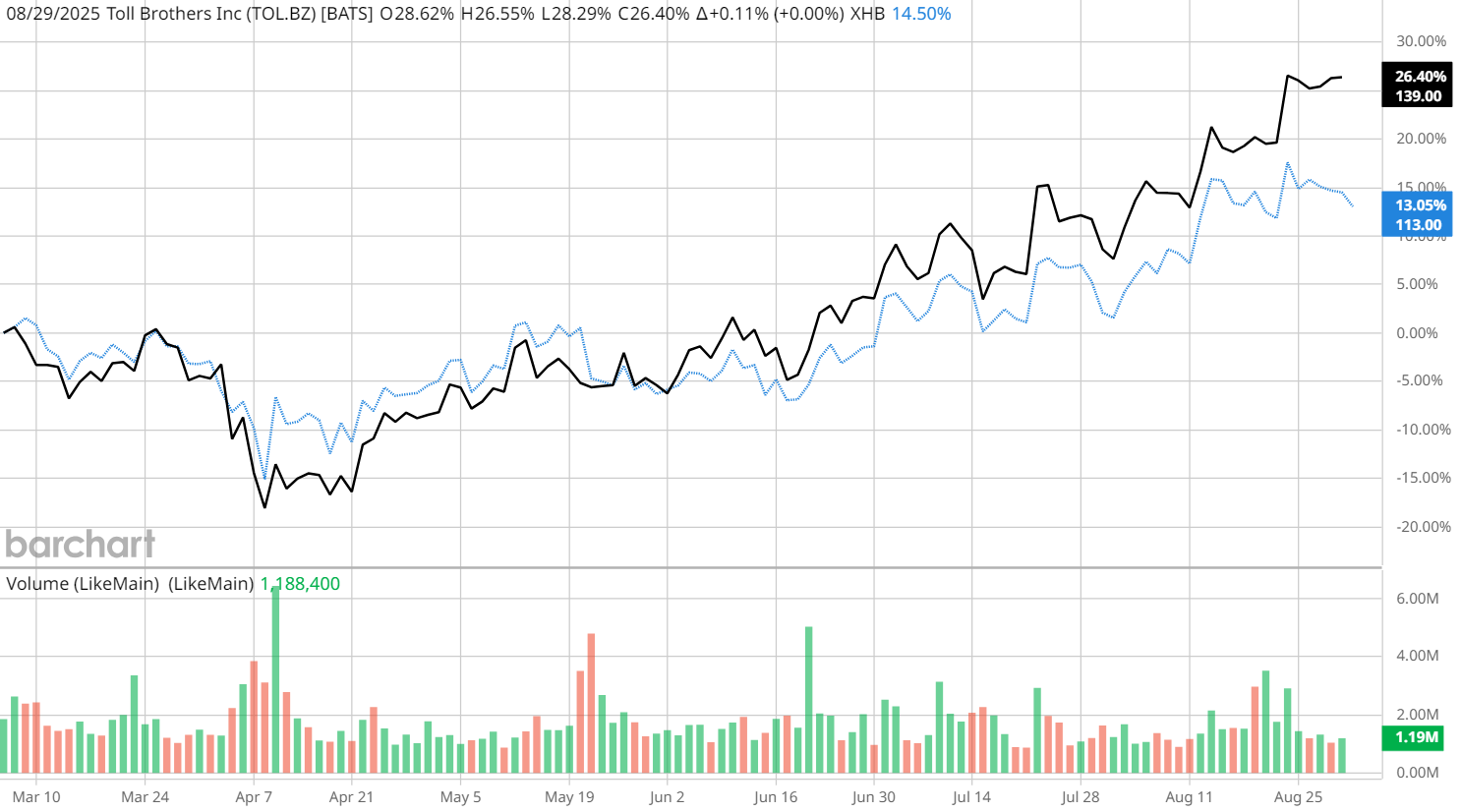

During the latest Market on Close livestream, John Rowland, CMT, highlighted an under-the-radar shift happening in the U.S. housing market — and why homebuilder stocks and ETFs might be primed for a breakout. With mortgage rates still elevated, single-family home affordability has hit a wall. But homebuilders aren’t sitting idle. Instead, they’re pivoting to a new model: “build-to-rent” communities. The New Builder Playbook: Build-to-RentHere’s how it works: Builders construct multifamily townhouses or rental-focused communities. They fill them with tenants. Then they sell the entire project to institutional buyers like BlackRock (BLK), Blackstone (BX), or KKR (KKR). This business model is working, and it’s supporting the charts of publicly traded builders with a strong footprint in the multifamily space. Toll Brothers (TOL), for example, has shown a strong, constructive chart pattern that correlates closely with the homebuilders ETF (XHB).

Buffett’s Signal: Berkshire Doubles DownThis isn’t just a technical story; it’s fundamental. Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) recently added to its stakes in D.R. Horton (DHI) and Lennar (LEN), two of the top multifamily builders. That move underscores the idea that even if single-family demand is cooling, the multifamily “build-to-rent” trend could power growth. Technical TailwindsRowland pointed out a looming “golden cross” setup, where the 50-day moving average crosses above the 200-day — often a bullish confirmation. Combine that with relative strength in the sector despite broader market profit-taking, and it paints a compelling technical backdrop. Why Homebuilders Matter to Investors

How to Track & Trade It with Barchart

Bottom LineThe story for homebuilders now goes well beyond rate cuts; it’s about how homebuilders are innovating in a tough environment, and how investors can get ahead of a sector rotation. Between Buffett’s bets, build-to-rent dynamics, and bullish technicals, housing deserves a closer look. Watch this quick clip now to hear John Rowland’s full breakdown and see the charts in action: On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|