|

|

|

|

|

Market Data

News

Ag Commentary

Weather

Resources

|

Tyler Technologies Stock: Is TYL Underperforming the Technology Sector?/Tyler%20Technologies%2C%20Inc_%20logo%20on%20phone%20-by%20T_Schneider%20via%20Shutterstock.jpg)

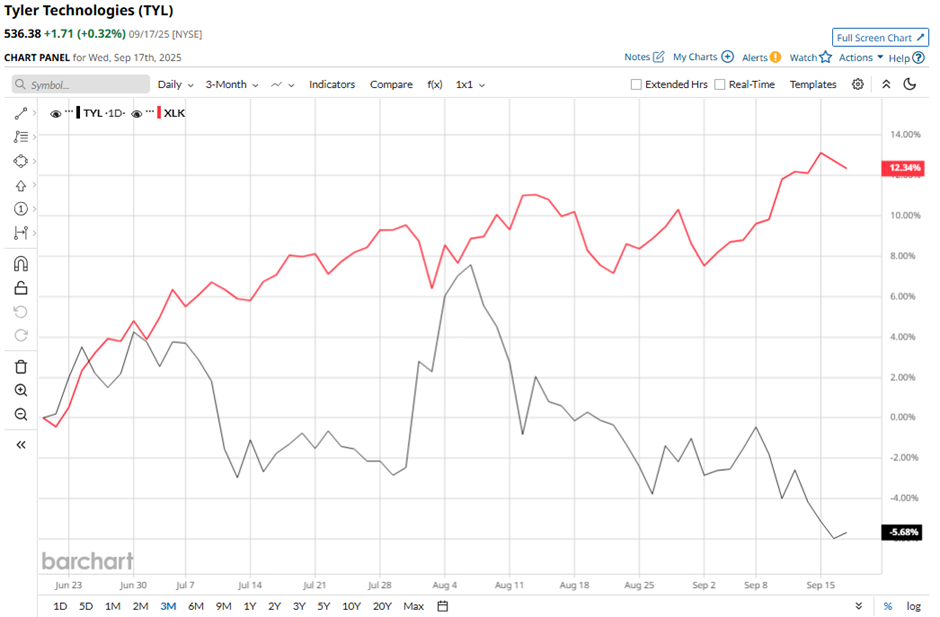

With a market cap of $23.2 billion, Tyler Technologies, Inc. (TYL) is a leading provider of integrated software and technology management solutions for the public sector. The company serves federal, state, and local government agencies, as well as schools and other public institutions, through a broad portfolio spanning financial management, courts and justice, public safety, property tax, land records, education, and health and human services. Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Tyler Technologies fits this criterion perfectly. Operating through its Enterprise Software and Platform Technologies segments, Tyler delivers both on-premise and cloud-based solutions, supported by a strategic collaboration with Amazon Web Services. Shares of the Plano, Texas-based company have dipped 18.9% from its 52-week high of $661.31. Over the past three months, TYL stock has decreased 7.6%, lagging behind the Technology Select Sector SPDR Fund's (XLK) rise of 12.5% during the same period.

In the longer term, shares of the information management software provider have declined nearly 7% on a YTD basis, underperforming XLK’s 16.7% return. Moreover, TYL stock has dropped 7.4% over the past 52 weeks, compared to XLK’s 23.8% gain over the same time frame. Despite few fluctuations, the stock has fallen below its 200-day moving average since early March.

Shares of Tyler Technologies climbed 5.4% after Q2 2025 results on Jul. 30. Adjusted EPS came in at $2.91 and revenue reached $596.1 million, above the forecasts. Investor sentiment was further boosted by management’s decision to raise its full-year revenue outlook to $2.33 billion - $2.36 billion, signaling continued demand for its IT and cloud-based solutions. In addition, rival Salesforce, Inc. (CRM) has shown a more pronounced decline than TYL stock on a YTD basis, dropping 26.9%. However, CRM stock has fallen 3.1% over the past 52 weeks, outpacing TYL’s performance during the same period. Despite the stock’s underperformance relative to the sector, analysts are moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 19 analysts in coverage, and the mean price target of $678.29 is a premium of 26.5% to current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|